You'll wish to make certain you're getting all the coverage you require, but that's simply the start. It's equally as important to make certain you're not paying for any type of coverage that you know you don't want. perks. An excellent insurance provider's agent will certainly lay out all the prices and coverages included within your plan for evaluation.

To find out just how they operate, you'll need to do a bit extra digging by discovering testimonials online on a range of sites. This is well worth the effort given that smaller insurance companies can potentially use prices significantly lower their bigger rivals in some areas. Crucial Factors to Consider, According to The Balance, there are a number of elements to think about when picking the most effective vehicle insurance provider for your needs.

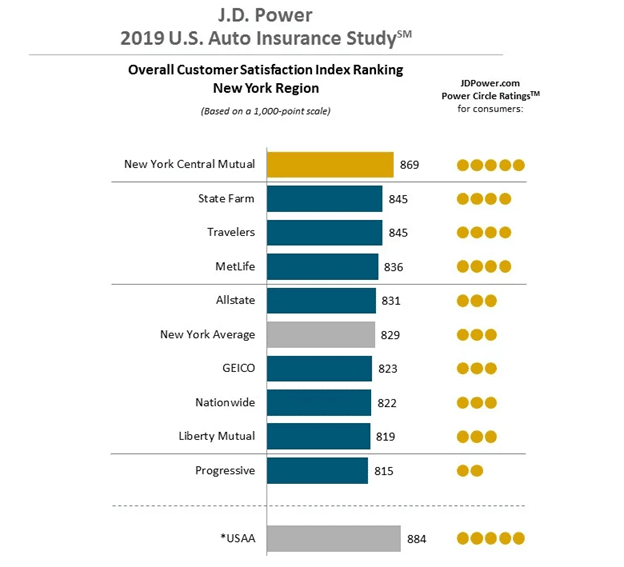

Consumer fulfillment is quickly determined by looking at the total consumer complaint ratings. People that are dissatisfied with insurance are extremely straightforward as well as motivated, so if there have been any grievances, they'll be easy to find (cheaper auto insurance).

Top Car Insurance Policy Business, To obtain the most effective price for your plan, you ought to take into consideration a few of the leading insurance provider, according to Plan Wizard. The complying with are the leading insurer in the nation, together with the benefits that they use: State Ranch is one of one of the most popular insurance companies in the country, with 17 percent of vehicles in the USA being covered by among their policies, according to Bankrate.

In Addition, State Farm uses numerous discounts that can alleviate the cost of including a teen motorist, such as the good pupil discount as well as Avoid program. If you're seeking affordability, GEICO is just one of the very best choices readily available - cheap auto insurance. Their costs are continually below par, and they have solutions for chauffeurs with bad credit history and also a history of crashes.

Pay Less For Auto Insurance - Credit Karma Fundamentals Explained

Their rates are regarding the same as State Farm, and they stand out in more unusual forms of insurance, like motorcycle insurance coverage. Allstate operates as a one-stop shop for most of your insurance coverage needs, with car insurance policy being simply one of numerous services they offer.

USAA insurance policy is consistently amongst the ideal in regards to expense and also insurance coverage, despite having vehicle drivers who have inadequate credit report, are teenagers, or have a background of at-fault mishaps. The only disadvantage is that USAA insurance coverage is just available to army members, professionals, and their family members - cheap car. With these aspects as well as business in mind, you'll be far better furnished to find the very best auto insurance policy for your requirements.

Begin your search as well as discover the very best vehicle insurance coverage by obtaining quotes today! This web content is developed and also preserved by a 3rd party, and imported onto this web page to help customers supply their email addresses. You may be able to locate even more info concerning this and comparable content at.

That's why it is very important to do your study and compare your choices when selecting the finest cars and truck insurer for your requirements. When you have a concept of what your costs may be from a couple of different business, after that you can look at aspects that set certain vehicle insurance provider besides others, like auto insurance coverage attachments or customer fulfillment scores.

vehicle dui car insurance perks

vehicle dui car insurance perks

automobile cars suvs dui

automobile cars suvs dui

Access, auto claims satisfaction, cost, and the company's monetary health and wellness are all vital variables we consider in our referrals. While no single car insurance company will be the very best for each individual, we believe these are the ones to take into consideration when in the marketplace for vehicle insurance. affordable. To identify our picks for the ideal auto insurance provider, we began with a checklist of 25 of the biggest auto insurer by premiums collected, based upon data from the National Association of Insurance Coverage Commissioners.

Rumored Buzz on The Best Car Insurance Companies Of April 2022 - Marketwatch

We dismissed any type of business that doesn't have A.M (cheaper auto insurance). Best's score of A+ or higher. We additionally eliminated any type of business that are involved in any energetic fraudulence investigations. Our Picks for the Ideal Vehicle Insurance Companies Company Overview, GEICO GEICO, the second-largest car insurance company in the nation, guarantees nearly 30 million vehicles, according to its website.

Automobile Insurance Claims Satisfaction Research. It likewise has the least expensive typical yearly premium of insurance firms on this list. This economical firm doesn't use one of the most unique discounts, but it offers several conventional discounts for clients like cost savings for bundling plans or for having even more than one auto on the policy.

The average premium gets on the greater end of the range, however there are lots of discounts to counter your automobile insurance premiums - prices. For example, you can obtain a price cut on your premium if you have a crossbreed or electrical vehicle or insure numerous lorries with Vacationers.$1,325: For drivers seeking a car insurer with strong client service, Travelers can provide.

Since 2019, it has 44 million active car plans in the united state $1,457 State Farm sticks out as an insurance provider for its reasonable rates, accessibility, and vehicle insurance claims fulfillment. State Farm's ordinary annual premium rate is somewhat higher than various other prices on this checklist, yet still reasonably low contrasted to the remainder of the industry.

If you do qualify for protection, they can be worth a look. USAAUSAA is a top cars and truck insurance provider in a number of categories. It places high in cost, customer fulfillment, and also its breadth of protection options. It just supplies insurance policy to military participants, veterans, and their households, making it an excellent one-stop purchase those because classification but not the rest of the united state

Best Car Insurance Companies For 2022 - The Motley Fool for Beginners

Much of its features are designed particularly for military participants' needs. Consumers can obtain reduced rates for reduced yearly gas mileage as well as up to a 60% discount rate for lorries saved throughout implementation. It has one of the highest cases complete satisfaction scores, according to J.D. Power. $1,225 USAA Coverage Kind Available, Responsibility coverage, Collision and also thorough insurance coverage, Uninsured and underinsured vehicle driver coverage, Injury defense and medical settlements, Roadside assistance, Rental automobile compensation, USAA Discounts, Safe driver discount, Pupil discount, New vehicle price cut, Driving training price cut, Multi-vehicle and also multi-policy discounts, Base and storage space discount rate, Mileage-based discount rate, Customer commitment discount rate Protective driving discount rate, Erie Insurance policy Erie Insurance does not supply insurance coverage across the country, however if you're searching for an affordable premium as well as reside in one of minority states it's offered in, it is notable for its reduced prices.

Although it's restricted to these states, its average yearly costs is the most economical of this checklist. Erie markets insurance coverage exclusively with its network of independent representatives and also none of its insurance offerings can be bought from the business directly. Erie has one of the highest possible insurance claims contentment ratings, according to J.D.

It's perfect for vehicle drivers that value an individually connection with a representative and also aren't worried regarding additional functions, such as an application or unique insurance coverage add-ons. Auto-Owners has the third greatest cases fulfillment scores, according to J.D. vehicle insurance. Power. Plus, its auto insurance policy rates are reasonably low compared to other popular insurers.

insurance affordable trucks cheapest auto insurance insurance

insurance affordable trucks cheapest auto insurance insurance

Regularly Asked Concerns What is the finest cars and truck insurance policy firm? There is no one-size-fits-all remedy when it comes to automobile insurance.

The Definitive Guide for Best Car Insurance Companies Of April 2022 - Time

What's the difference between buying from an independent insurance agent or a captive insurance representative? Can you get cars and truck insurance coverage without a representative? There are a few ways you can get auto insurance coverage. auto. You can buy it online without an agent's assistance, yet it does call for even more research in terms of understanding and comparing plans.

Getting involved in an accident, specifically if you're at mistake, will likely lead to higher prices in the future. Some companies, such as Allstate as well as Farmers, may provide mishap mercy that prevents a mishap from raising your rates. USAA, GEICO and State Ranch may supply the most affordable rates if you haven't remained in a mishap or have actually remained in one at-fault mishap.

Best Automobile Insurance Policy Rates for Young Drivers, As any person that's included a teen to their automobile insurance coverage can inform you, young drivers tend to be expensive to guarantee. Prices go down as you obtain older, and also can level out once a motorist is in their mid-20s (low cost auto). If you're a young person (or someone covered by your policy is), you may want to purchase brand-new quotes after every birthday celebration.

Amongst the more conventional insurer, USAA, State Farm and also GEICO might supply the most affordable prices. But often, there will not be a large difference unless you choose a usage-based plan. dui. Best Car Insurance Rates Based Upon Your Credit report, In most states, credit-based insurance scores can be an element in identifying your auto insurance policy costs.

At a minimum, most states need drivers to have obligation protection, which spends for others' clinical costs and also damages to their property. You may likewise need to purchase medical insurance coverage or personal injury defense, which can assist spend for your (as well as your passengers') medical treatment. If you want coverage in case your vehicle is harmed or swiped, you'll need accident protection (for damage from mishaps) and thorough coverage (for burglary and also damage brought on by something besides a crash, such as a storm).

Getting The Free Car Insurance Quote - Save On Auto Insurance - State ... To Work

However, it's a tradeoff as more protection and reduced deductibles also result in higher costs. How to Obtain the Best Rates on Your Auto Insurance No matter which kinds of coverage, limitations and also deductibles you pick, there are a couple of ways to save money on auto insurance coverage: There's no insurer that uses the most effective rate for everybody.

accident insured car cheap insurance dui

accident insured car cheap insurance dui

Therefore, boosting your credit rating might help you get approved for better rates - vehicle insurance. Some insurance policy business, such as Freedom Mutual, use a price cut if you purchase your coverage online. Modern and also Elephant Insurance even offer you a discount rate if you get a quote online and get the plan with an insurance coverage agent. You will not always discover a cost savings chance, but the aspects that establish your rates, your insurance policy requires and also the firms' offering and also choices can all transform over time.

, may provide mishap forgiveness that protects against an accident from raising your rates. car insured. USAA, GEICO and State Farm might provide the cheapest prices if you haven't been in a crash or have actually been in one at-fault mishap.

Finest Car Insurance Prices for Young Vehicle drivers, As any individual that's included a teen to their vehicle insurance coverage can tell you, young vehicle drivers have a tendency to be pricey to insure. Costs drop as you get older, and can level out as soon as a chauffeur is in their mid-20s. If you're a young person (or someone covered by your plan is), you may wish to look for new quotes after every birthday.

Amongst the much more conventional insurance coverage business, USAA, State Farm and also GEICO may provide the most affordable prices. Yet frequently, there won't be a huge distinction unless you go with a usage-based plan. Best Car Insurance Coverage Rates Based Upon Your Debt, In a lot of states, credit-based insurance coverage scores can be a factor in determining your automobile insurance costs.

Not known Incorrect Statements About Hdfc Ergo - General Insurance Policy Online - Buy Car ...

At a minimum, the majority of states need drivers to have liability protection, which pays for others' medical bills and damage to their residential or commercial property - car insurance. You might likewise have to purchase clinical insurance coverage or accident protection, which can aid spend for your (as well as your guests') healthcare. If you want coverage in situation your car is harmed or stolen, you'll need collision protection (for damage from mishaps) and also extensive coverage (for theft and damages triggered by something besides an accident, such as a tornado).

Nevertheless, it's a tradeoff as even more insurance coverage as well as reduced deductibles also cause greater costs - car insured. How to Obtain the Ideal Prices on Your Automobile Insurance No issue which kinds of coverage, limitations and deductibles you pick, there are a few ways to conserve cash on vehicle insurance: There's no insurance provider that supplies the most effective rate for everyone.

Because of this, boosting your credit scores might follow this link assist you qualify for far better prices. Some insurer, such as Freedom Mutual, provide a discount rate if you get your protection online. Dynamic as well as Elephant Insurance also offer you a discount if you get a quote online and also acquire the policy with an insurance coverage representative. You won't always locate a financial savings opportunity, however the aspects that determine your rates, your insurance policy needs as well as the companies' offering as well as choices can all transform in time.