Automobile insurance typically provides 3 sorts of insurance coverage, or security, with various states having various minimum protection mandates. BZ 3 Kinds of Security in an Automobile Insurance Plan: this covers occasions like theft or damages to your car in an accident.: this supplies financial protection for your or others medical expenses need to any type of arise from an accident or occasion while driving your vehicle.

As an example, if you live in a state that utilizes Injury Security to provide medical insurance coverage on your vehicle insurance coverage plan, you'll have selections of protection as reduced as $15,000 in some states. A reduced quantity of. laws. A representative or manufacturer may likewise recommend a higher deductible for your PIP, also to maintain expenses down.

You might need to pay another insurance deductible and co-pay. Even if your deductible is only $500 without co-pay, you're still paying $3,500 out-of-pocket now. As you can see, the savings offered via lower protection restrictions as well as greater deductibles might be tempting, but also might not be worth the economic danger relying on your specific economic scenario.

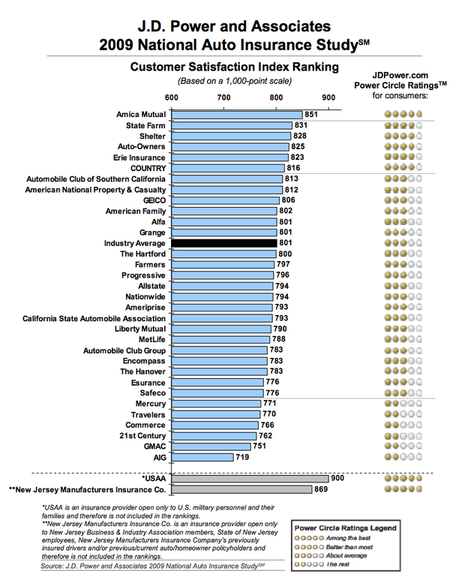

Automobile Insurance Estimates Lots of companies deal with insurance policy as an asset, typically offered as well as with little distinction in attributes or options. Amica as well as our Special Reference choice, USAA, both acknowledge that clients are getting service, not just insurance coverage. Insurance coverage rates are individualized, so it is essential for customers to shop about (auto). One business might treat you better than another in relation to rate.

Packing your items is one more method to decrease your automobile insurance coverage costs. responded to 2022-04-18 Benzinga Just how do I make certain that I'm appropriately covered for auto insurance coverage? 1 How do I guarantee that I'm properly covered for cars and truck insurance policy? asked 2022-04-18 Eric Huffman 1 The finest point you can do is speak with your insurance policy carrier or agent as well as be sincere concerning your vehicle and also driving history.

The Definitive Guide for Compare Car Insurance: How To Choose The Right Policy

cheap car insurance perks perks cheap

cheap car insurance perks perks cheap

Generally, it's a good suggestion to contrast policies from at the very least three different insurance providers. You'll desire to take into consideration basic variables such as insurance coverage and also rate, but it's additionally worth evaluating possible insurance firms.

Kinds and quantity of protection Attempt to contrast apples to apples when picking your insurance coverage. Every one of the plans that you review ought to have the same types and also amount of protection. business insurance. It is tough to compare plans, for example, if one supplies $50,000 in residential or commercial property damages liability coverage, an additional only $30,000, and a third $100,000.

Evaluating insurance companies While cost and also protection may be making a decision variables when you buy vehicle insurance, it's worth thinking about the reputation and monetary stability of prospective insurance policy suppliers - low cost auto. First, double-check that an insurer is licensed in your state by visiting the website of your state's insurance policy department where you can likewise assess details about customer issues filed versus insurance coverage companies.

Online devices will certainly usually provide ratings information.

laws insurance affordable dui auto

laws insurance affordable dui auto

You're about to move: Where you live is a crucial factor in identifying your prices. Your credit history have actually transformed considerably: Vehicle insurance provider with the exemption of those in The golden state, Hawaii, Maryland and Massachusetts consider your credit score when setting your rate - cheaper cars. Your motoring background has boosted: If it's been awhile considering that your last accident or driving infraction, your price might improve.

The 10-Second Trick For Best Car Insurance Companies In India 2022 - Policybazaar

Your driving regimen has altered: If you're driving fewer miles nowadays or no longer commuting for job, you may wish to shop around to see if you can get a lower rate (cheapest car insurance).

Whether you are a newbie customer taking a look at obtaining an automobile insurance coverage policy for your brand-new auto or you are a person who is taking a look at switching to a brand-new business, among one of the most essential things before you start the process of getting in touch with insurer is to initially do your very own research.

Once you accumulate this information, it is essential to consider some of the auto insurance coverage companies you have in mind online as well as compare them. In certain, customers must check out their protection requires obligation, which is called for by the majority of states, full coverage/comprehensive insurance (important and called for if your automobile is financed), without insurance and also underinsured driver protection, accident coverage, individual injury defense insurance coverage, etc - cheap car insurance.

Liability insurance is mandated by most states, Accident insurance policy covers you despite mistake, Comprehensive/full coverage insurance policy covers you in situation of damages to autos created by unforeseen disasters or "disasters"-- events such as hailstorm or a fallen tree arising from extreme climate condition, or your vehicle hitting an animal, etc.

Complete insurance coverage vehicle insurance costs will certainly vary for each and every customer depending upon their credit rating as well as driving and crash background. As a result, each person's circumstance is unique. If you are a brand-new chauffeur or adolescent chauffeur and even somebody that is risk-averse, after that it is better to take detailed, collision, and also uninsured/underinsured, along with clinical payments protection and individual injury protection, in addition to the liability insurance policy that many states mandate.

Cheap Car Insurance - Affordable Auto Insurance - Liberty Mutual Can Be Fun For Everyone

Lots of business will certainly be pleased to get your organization and looking at developing a lasting relationship with new clients.

Final Judgment Numerous vehicle insurance coverage firms around Take a look at the site here might offer the protection you need. They may not offer the most affordable cost or the best coverage, which is why it is important to go shopping as well as compare your alternatives. Based upon our specialist analysis, we selected State Farm as the general best cars and truck insurance coverage business for 2022. car.

: Many car insurance policy companies offer a number of ways to conserve, such as price cuts for secure vehicle drivers, university student, or armed forces members.: Most insurance provider cover the fundamental comprehensive as well as accident insurance coverage, however there are also various other, specialized protections that may not be so frequently located, such as electric or traditional auto insurance.: Each kind of protection features an optimum limitation that reveals specifically just how much of your losses will certainly be covered by your insurance provider.

What Does Vehicle Insurance Coverage Cover? Cars and truck insurance policy covers damages to your lorry, in addition to other automobiles or property if you're associated with a mishap. It can additionally cover medical bills ought to there be any kind of injuries and also any legal charges that may emerge after a crash. What Are the Various Kinds Of Cars And Truck Insurance Coverage? There are several types of cars and truck insurance policy, including collision protection for mishaps and detailed protection for natural acts, like typhoons or hail storm.

For additional details concerning our choice standards and also procedure, our complete technique is readily available (car).

Not known Facts About How Important Is Car Insurance? - Phoneswiki

Most of US chauffeurs will certainly require to obtain some form of cars and truck insurance coverage, as all yet two states (New Hampshire and also Virginia) require residents to acquire a plan before supporting the wheel. Beyond being lawfully called for, adequate insurance protection is crucial to driving, as it safeguards you from incurring excess prices if you get in a crash.

The typical yearly costs for complete insurance coverage is $1,655, according to Bankrate, yet depending on the amount of insurance coverage you acquire,. To make sure that you're obtaining the very best rates and insurance coverage, you'll wish to do an automobile insurance evaluation every now and then. car insurance. Allow's dive in. Best car insurance policy companies The top-scoring vehicle insurance service provider overall was Geico, reporting high client complete satisfaction levels in all regions of the country.

Its consumers offer it remarkable scores for fantastic solution and also assistance, together with a few of the most reasonable insurance costs - car. Geico's smart commercials have made it one of the best-known cars and truck insurer in the nation, and also it ranks high in general consumer complete satisfaction as well as auto claims complete satisfaction, according to J.D.

What impacts the USAA's position is that its range is narrower than those of most other automobile insurers, as the company only supplies protection to solution participants, professionals and their households - low cost. That claimed, USAA is among the most cost-efficient insurance firms available, providing rates that also defeated Geico's. Customers that switch save an average of $725 a year.

Not known Facts About Best Car Insurance For Teens And College Students Of 2022

cheap insurance dui cheapest car car insurance

cheap insurance dui cheapest car car insurance

Frequently asked questions What's the best automobile insurance coverage? Geico, Travelers, USAA, The Hartford and Amica are our top auto insurance picks for most chauffeurs. High customer fulfillment ratings and affordable rates are amongst the factors we selected these service providers, however they aren't the just great alternatives available. It may be worth exploring various other well-known insurance service providers, like Allstate, State Farm and also Progressive.

For instance, while State Farm boasts high automobile claims contentment ratings, they also have greater than 1. 5 times the market standard in customer issues, according to the National Organization of Insurance Commissioners. In addition, we've put together extra lists based upon various metrics. Review our finest vehicle insurance policy referrals for least expensive automobile insurance coverage, military participants and teens and also young vehicle drivers.

When purchasing for vehicle insurance, you'll discover that rates vary by area which state laws dictate which coverage is called for on your plan and what the minimal limitations are, also. There are a lot of excellent insurance policy firms that run regionally or only in a select quantity of states.

auto cheap insurance insurers cheaper car insurance

auto cheap insurance insurers cheaper car insurance

Auto-Owners uses coverage in only 26 states, while Erie offers it in simply 12 (suvs). What kind of insurance coverage does your state legitimately require you to have? In a lot of states, bodily injury obligation protection and also home damages liability are essential to drive, however you'll want to examine the specifics of insurance policy premiums with automobile insurance coverage service providers where you live.

Compulsory; 2. Commonly required; 3. Optional. Note that this checklist does not consist of all sorts of insurance coverage used by service providers-- these are just one of the most typical. Necessary coverage: Simply regarding all states call for both kinds of protection below, which do not cover damages to your own car or property.: This coverage spends for injuries to others triggered by the insurance holder and other vehicle drivers provided on the policy.

Examine This Report about Compare Car Insurance: How To Choose The Right Policy

If your vehicle is financed, your loan provider might require you to lug complete coverage, indicating both thorough as well as crash. This coverage spends for damages to your car in a mishap arising from a collision between your auto and also one more auto or an object (cheap auto insurance).: This coverage pays for damage to your vehicle created by an event various other than collision.

However, we might receive compensation when you click on web links to product and services offered by our partners (accident).

READY TO FIND THE IDEAL VEHICLE INSURANCE POLICY FOR YOU? The Finest Cars And Truck Insurance Firms for 2022Money, Nerd has actually ranked the best cars and truck insurance coverage firms based on numerous aspects, consisting of J.D. Power consumer contentment scores, economic security rankings from AM Ideal and price.

GEICO received the highest marks in our racking up system for 24 out of 50 states, while State Farm rated as the leading company in 10 states. These positions, and our research study on what makes these firms stand out, can aid you when purchasing vehicle insurance coverage. Those simply trying to find the most inexpensive option can contrast this list to our rankings of the cheapest automobile insurance provider.

Nevertheless, GEICO might not be the very best option for those with a brand-new car. The firm doesn't use brand-new auto substitute protection, which allows those with brand-new models to be totally repaid for a brand name new car after a mishap. Without this, you'll just be reimbursed for the diminished worth of your car.