cheaper cars cheap car insurance auto insurance

cheaper cars cheap car insurance auto insurance

Often Asked Concerns Regarding Auto Insurance Coverage Price Just How Much is Auto Insurance Coverage for a 25-Year-Old? Depending on your car insurance company and also the responsibility coverage you pick, a 25-year-old may pay even more or much less than their state's average cars and truck insurance policy expense each month. When you turn 25, you must call your car insurance provider to see if you can save money on your automobile insurance coverage price if you have a great driving history. car insured.

You will certainly require to hold at the very least the minimum needed coverage in instance of a mishap. cheap. You may also go with additional protection that will raise your price, yet additionally increase your defense in case of an accident. Just How Much Is Full Coverage Insurance Coverage per Month? Complete insurance coverage automobile insurance coverage is not the same for each and every of the 50 states.

What Autos Have the Lowest Insurance Rates? When it pertains to the average automobile insurance coverage cost each month for different kinds of automobiles, vans commonly have the least costly insurance policy costs. car insurance. Sedans typically have the highest possible auto insurance coverage price each month, while sporting activities utility Discover more lorries as well as trucks are priced in between.

At What Age Is Cars And Truck Insurance Coverage the Cheapest? Auto insurance policy premiums vary based on lots of variables, including age. Chauffeurs who are under 25 as well as over 60 years old typically pay one of the most for vehicle insurance coverage. No matter your age, if you intend to reduce your auto insurance prices, you need to locate an automobile insurer that can provide you discounts as well as benefits.

Last Updated on November 27, 2020 Having a cars and truck uses lots of flexibility as well as independence for young adults (trucks). It's very essential for young motorists to have an automobile insurance plan they can depend on. The average cost of vehicle insurance for an 18-year-old driver can be costly, yet there are manner ins which you can maintain your premiums down.

Just How Much Does Cars And Truck Insurance Price for 18-Year-Olds in NY? The ordinary price of vehicle insurance for an 18-year-old in New York can be quite costly.

How To Qualify - Ct.gov - The Facts

The more statistically dangerous a chauffeur is, the more expensive their car insurance policy premiums will be. Cost can differ extensively depending on who you are, also for young motorists - cheaper car insurance. Below Are Some of the Aspects That Can Impact Your Cars And Truck Insurance Costs:: 18-year-old chauffeurs that have some experience on the roadway will likely see slightly less costly premiums than new vehicle drivers.

18-year-olds that have already had insurance for a year might see slightly less expensive premiums than those who are obtaining an insurance coverage plan for the first time.: Where you are driving can likewise influence the general price of your insurance coverage. Vehicle insurance coverage in New York is currently more than in numerous various other states for a number of factors, including the quantity of traffic in the state's huge metro locations.

vehicle insurance auto vans risks

vehicle insurance auto vans risks

: The kind of auto you have can additionally determine the total cost of your vehicle insurance - low cost. Some automobiles are statistically more secure to drive, which implies that they will certainly have lower premiums. Features like anti-theft gadgets can additionally make your car much safer and also lower the expense of your insurance generally.

Automobile insurance policy firms make up for this included danger by charging even more to cover young chauffeurs. The good news is, the ordinary price of vehicle insurance policy goes down dramatically as soon as drivers hit their twenties.

The very first point to do is to ask your insurance coverage company for a complete list of discounts they use., which uses to all high school and also college pupils with a Grade point average over a certain level.

In New York state, all vehicle drivers can gain a discount on their insurance simply by taking one of these short courses. Not just will it aid you conserve money, but these programs can instruct young vehicle drivers vital skills that will certainly aid them stay secure and make great choices on the roadway.

The Buzz on Highway Code To See Major Change To Accommodate Self ...

They are well versed in the sector and will be able to aid you locate a policy that takes all of your requirements into consideration. Discovering the right vehicle insurance for a new motorist is so essential. Although automobile insurance coverage for 18-year-olds in New york city can be expensive, looking around can assist you discover the right policy for your needs.

money cheaper car insurance companies affordable auto insurance

money cheaper car insurance companies affordable auto insurance

According to the Centers for Condition Control and also Prevention, vehicle drivers ages 15 to 19 are four times more probable to collapse than older motorists, making auto accident the No. 1 reason of fatality for teens. accident. Also teens with clean accident documents will encounter high vehicle insurance policy rates for numerous years because of their absence of driving experience.

Reducing Vehicle Insurance Coverage Premiums for Teenage Motorists, There are means to minimize automobile insurance coverage prices for a teen motorist, but acquiring an auto for the teen as well as placing him on his own plan isn't one of them. The average annual price estimated for a teen motorist is $2,267. (This average consists of all liability protection degrees.) Compare that to a typical boost of $621 for including a teen to the moms and dads' policy that means you'll pay 365 percent a lot more by placing the teen on his/her very own policy - insurance company.

However the most effective method to hold rates down is to see to it your teen maintains a clean driving record. Including a teenager to your insurance policy will certainly no question enhance your rates, but there are things you can do to counter the new prices and lower your cars and truck expenses.

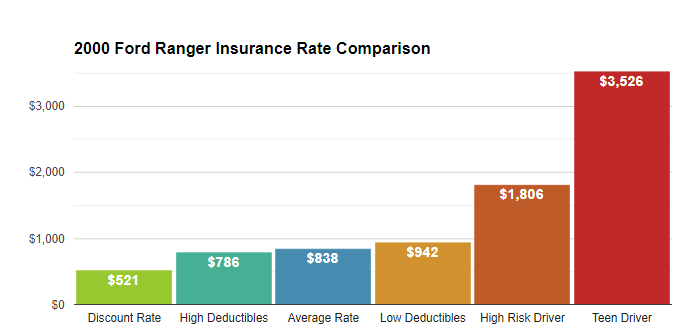

When it involves teen drivers and automobile insurance policy, things obtain complicated-- as well as pricey-- quickly - vehicle insurance. A parent including a male teenager to a plan can anticipate car insurance price to balloon to more than $3,000 for full coverage. It's also greater if the teenager has his own policy.

Now, that we've assessed those sobering truths, let's overview you through your automobile insurance purchasing (vehicle insurance). We'll look at discounts, options as well as special circumstances-- so you can find the finest cars and truck insurance policy for teenagers. Although the appropriate solution is typically to include a teen onto your policy to minimize some of the expense, there are various other alternatives and also discounts that can save money.

About Best Car Insurance For Teens, Students, And New Drivers

Trick TAKEAWAYSAccording to the government Centers for Illness Control and also Avoidance, the worst age for accidents is 16. If the pupil prepares to leave an automobile at house and also the university is even more than 100 miles away, the college trainee could qualify for a "resident trainee" discount or a student "away" price cut.

IN THIS ARTICLEHow much is auto insurance coverage for teens? The younger the chauffeur, the extra costly the vehicle insurance policy. insured car. Young motorists are much a lot more most likely to get into cars and truck crashes than older drivers.

A study by the IIHS discovered states with stronger finished licensing programs had a 30% lower deadly collision price for 15- to 17-year olds. Including a teenager to your car insurance plan, Adding a teenager to your automobile insurance coverage policy is the most inexpensive method to get your teen insured. It still comes with a hefty price, however you can absolutely save if you select the very best automobile insurance provider for teenagers.

We added a 16-year old teen to the plan. Below's what occurred: The ordinary family's auto insurance coverage bill rose 152%. An adolescent boy was a lot more costly. The average costs climbed 176%, compared with 129% for teenage women. The golden state prices increased the most, more than 200%. The reason behind the hikes: Teens crash at a much greater rate than older drivers.

They have an accident rate twice as high as vehicle drivers that are 18- and 19-year-olds. Costs vary by insurance coverage firm, which is the factor we suggest purchasing for teen motorist insurance coverage.

Simply see to it your teen isn't driving on a complete certificate without being formally contributed to your plan or their own. That would be risky. If my teenager obtains a ticket, will it raise my prices?. As soon as together on the same policy, all driving documents-- including your teen's-- influence costs, for better or even worse - insure.

An Unbiased View of State Of Montana Snap Program Overview

Can a teen obtain their own auto insurance coverage plan? State regulations vary when it comes to a teenager's capacity to sign for insurance.

Your teenager will likely have a higher premium compared to including a teenager to a moms and dad or guardian plan. Nonetheless, there are situations where it may make good sense for a teen to have their very own policy. Progressive mentions two: You have a deluxe sporting activities cars and truck. On a solitary strategy, all chauffeurs, including the teenager, are guaranteed versus all automobiles.

Cars and truck insurance is different for a first-time car insurance purchaser, yet it's a blast to begin a partnership with an insurance policy company. Exactly how to reduce teen vehicle insurance policy? Teenagers pay more for car insurance coverage than grown-up chauffeurs because insurance policy suppliers consider them high-risk. There are methods teen drivers can conserve on their automobile insurance costs.

Weigh against the fact that young chauffeurs are much more most likely to obtain into accidents. When you get right into an at-fault mishap, you have to pay the insurance deductible amount. Boosting your deductible from $500 to $1,000 will lower your yearly costs by roughly $400 - car. You can additionally drop extensive and also collision protection if the car isn't financed and also unworthy much.

A cars and truck with a high safety and security rating will be cheaper to guarantee. This isn't really a popular option for an excited teen chauffeur, yet it's worth considering.

You must also comprehend the insurance firm still charge greater prices for the first few years of the certificate. An additional way to lessen your insurance coverage costs is to get on your own of the discount rates readily available. A few of them are discussed below, Discount rates for teen drivers, We've recognized the most effective price cuts for teenager motorists to obtain inexpensive auto insurance policy.

The Basic Principles Of How Much Is Car Insurance? - Nationwide

That's $361 usually. You can take extra motorist education or a defensive driving training course. This suggests exceed and past the minimum state-mandated motorists' education and also training. In some states, discounts can run from 10% to 15% for taking a state-approved chauffeur enhancement class. Online classes are a convenient option yet talk to your carrier initially to see to it it will cause a price cut.

The average pupil away at school price cut is more than 14%, which is a cost savings of $404. This means you don't obtain right into any kind of crashes or violations.